$15 Billion is going to be credited amongst ten millions of US households on Thursday as the first monthly payment of the expanded child tax credit expected to be continued till December.

The Internal Revenue Service provided families with payment for up to $300 per child under the program that’s focused on combating child poverty with negotiating annual lump-sums of tax refunds into foreseeable household income. The Biden administration claim to have paid over $15 billion and most of it was paid via direct deposits to families with an average of 60 million children. These payments are supposed to continue throughout December as Congress is still under debate, whether to continue these payments or not.

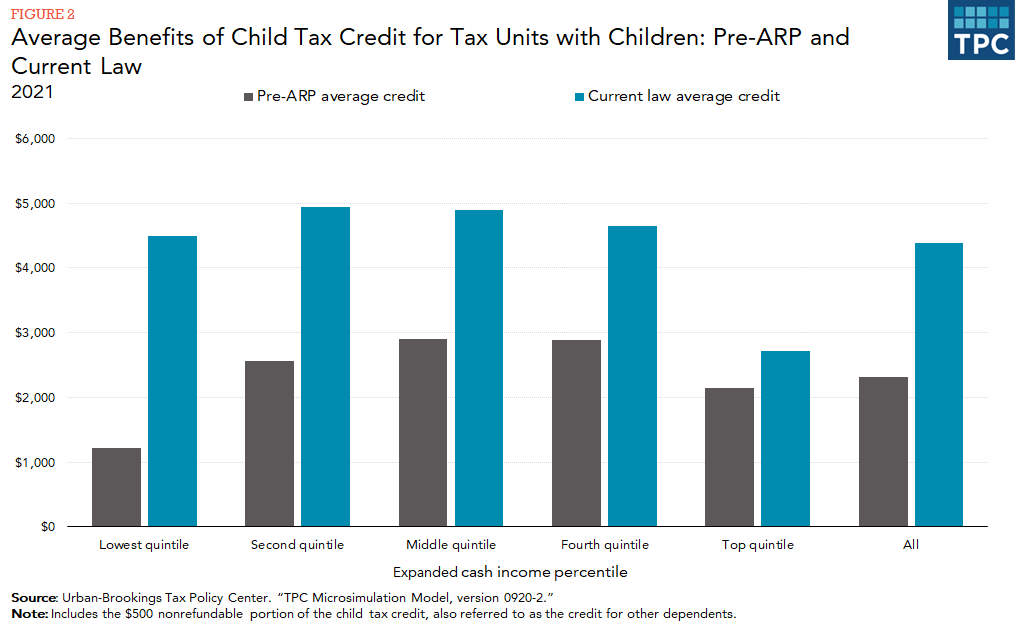

According to the March Coronavirus relief law, Congress had expanded this credit by $100 billion. The credit amount was worth up to $2000 for 16-year-olds and under-aged children. Currently, it’s worth up to $3000 for 6 to 17-year-olds and $3600 for children under 6.

The increased amount of the payments will shrink once an individual’s income reaches $75,000 and $150,000 for married couples. Homes that earn above this bar continue to receive the payment of $2000 credit, which maintains the early income phase outs beginning at $200,000 for individuals and $400,000 for couples.

Bottom Line: Solely for combating poverty IRS has issued payments for families with $300 per child as 1st pay out for the expanded child tax credit.