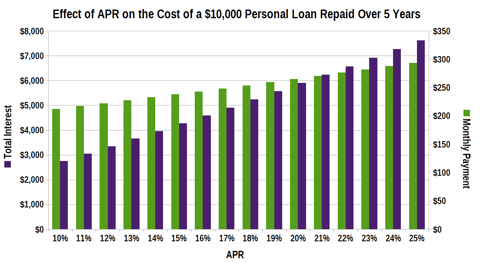

On Tuesday, the top US bank regulators declared, they would work cooperatively to rationalize the rules governing how each bank would lend hundreds and billions of dollars annually among the lower-income communities.

The officials further added, “they would move to scrap a Trump-era overhaul of the rules that had divided regulators and industry officials”.

At this time, when banking is mostly done online, the regulators are trying to forge down an agreement for updating the rules which are continually being used for over 40 years now, since the time when banking was done at physical branches.

On Tuesday, Acting Comptroller, Michael Hsu said, “While the OCC deserves credit for taking action to modernize the CRA through the adoption of the 2020 rule, upon review I believe it was a false start”.

The Comptroller’s Currency Office, the one that oversees national banks and takes care of the low-income lending rules bulk activity, wants to propose withdrawal controversial changes, they had pushed off last year short of the Federal Deposit Insurance Corp. and Federal Reserve’s support. A couple of other bank regulators were additionally responsible for directing the Community Reinvestment Act.

Bottom Line: Bank regulators agree to go together after remodeling Company Reinvestment Act rules so that it becomes easier lend hundreds and billions of dollars among the lower-income people by each bank every year.