A federal judge in California sentenced Hamid “Ray” Adkhavan to 2 ½ years in prison on Friday for masterminding an international scheme to get U.S. banks to process over $150 million in marijuana-related transactions.

The move by federal prosecutors and U.S. courts highlights the challenges currently facing the rapidly growing cannabis industry in the United States.

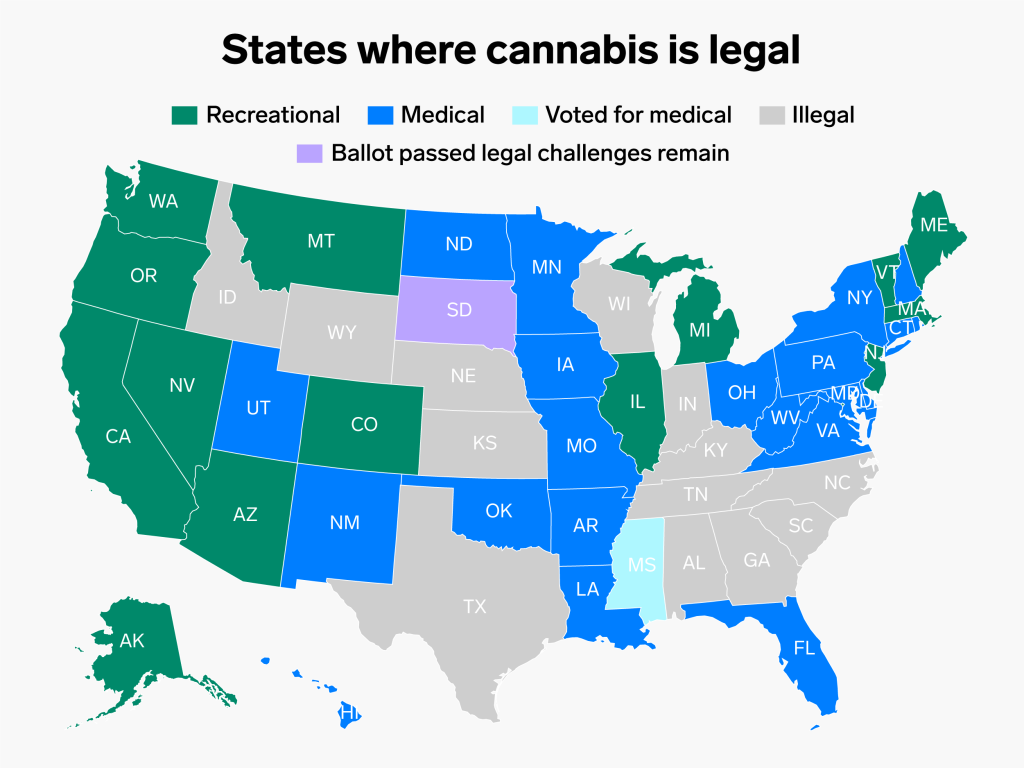

While every state in the union, and Washington D.C. have legalized marijuana to some degree (with the exceptions of Idaho, Wyoming, Kansas, Tennessee, and South Carolina), the non-man-made drug remains “scheduled” on the U.S. Congress’ list of prohibited substances.

Ray Akhavan, 43 years-old and a partner at Long Arc Capital, a private equity firm based in New York, helped cannabis businesses in the marijuana supply chain to disguise purchases of the industry’s wares using shell companies and fake inventory codes.

A German e-commerce consultant, Ruben Weigand, was convicted along with Adkhavan in March on respective charges of bank-fraud conspiracy.

Bottom Line: The U.S. cannabis industry achieved some $17.5 billion in cash receipts in 2020, growing sales by nearly half over the previous year. As far back as 2017, Forbes noted the explosive growth in cannabis sales was comparable to the expansion of broadband Internet in the 2000s. And the U.S. federal reserve banks don’t seem to want their business.