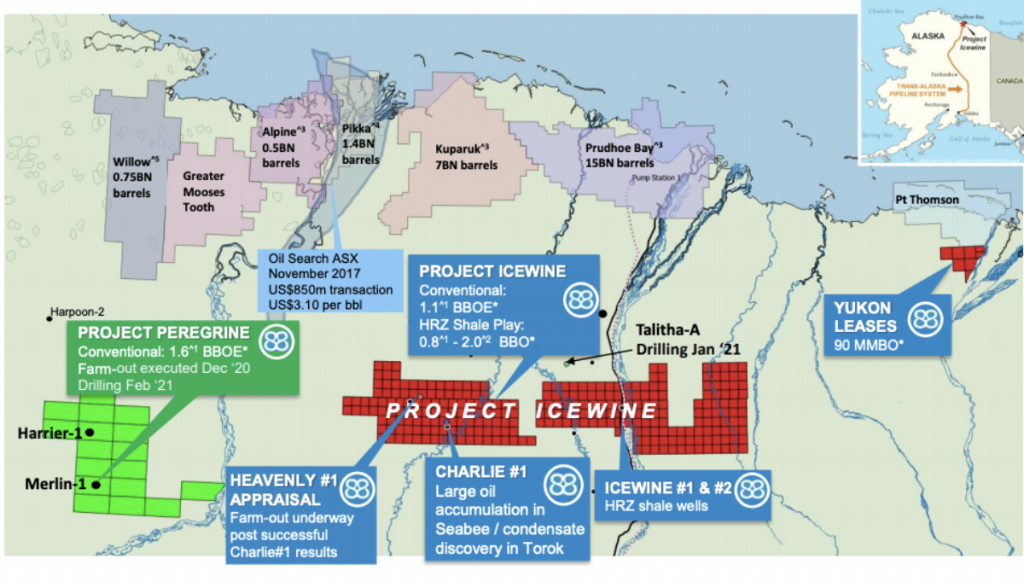

88 Energy (OTCMKTS: EEENF) is an Alaskan oil driller company & It mainly aims to explore and find new sources of natural minerals. They have access to 440,000 net acres on the Alaskan Central North Slope & this land potentially has 50 billion barrels of oil.

In March of 2021, There were a lot of optimistic catalysts that helped this company gain some momentum, including the news that they found a hydrocarbon zone in Alaskan North Slope during drilling at Merlin-1 & the acquisition of, the Umiat Oil field, a proven drilling site.

However, the stock “crashed” 66% in April when their drilling in Merlin-1 failed due to equipment failure. However, on the good side, One of the zones discovered during the wireline program, according to 88 Energy, “is regarded to be a new perspective horizon within the Nanushuk Formation,” which might be entirely within Project Peregrine. This was not one of the drill’s pre-planned objectives.

Looking at their recent fiscal year 2020 balance sheet, their total asset is about 65.78M, while their liabilities is about 20.38M

Our take: We feel this company has a lot of potentials, and right now is what we call, “early bird special” if this company strikes oil. The over-reaction “crash” should recovery easily with just 1 new catatlyst. We see it going up to .85 cents to 2$ within a 1-year time frame if everything goes well. Although a lot of people are looking to make a quick buck off from this company, this company can do well in long term given that they continue to what they are doing & & focus on acquisitions for existing proven drilling sites.

DISCLAIMER: I am not a licensed financial advisor. Please invest with caution.