Venture Capital (VC) is a form of private equity used to fund the operation of either a brand new startup or to expand an already established business with a lot of potential. Venture Capital usually comes in two ways: Venture Capital Firms or Angel Investors.

Venture Capital Firms: These are businesses whose job is to make bet on a bunch of potential companies and hope that one of them will me acquired or goes public. ( Called “unicorn” because it happens out of thousands of companies but it makes up for all the other losses venture capital has funded. ) These VC Firms know that most of the startups will fail, that’s why they are playing the numbers game. Most VC firms specialize in certain types of investments, such as Software, Real Estate, Trademarks, etc. Raising funds from VC Firms is a little difficult because they are experts looking for certain kinds of things before making their investment, but they can fund large fundraise and also provide the help you need to reach to next level.

Yes, there are other variations of this such as crowdfunding, but they all fall under one of these two categories. For example, Funds that you secured from your family & friends could be put under Angel Investors. Syndicates can be placed into Angel investing because they raise money from small investors in the amount of $1,000 to collect money.

Angel Investors: As the name says, These are individuals who have money to invest but don’t really want to be bothered with legal paperwork or following up, so they usually partner up or we call become a “syndicate” of another person who is leading the fundraising. Some places require that you are an “accredited investor” in order to become an “Angel Investor”, which means that they have an annual income of at least $200,000, or $300,000 if combined with a spouse’s income. You can become an angel investor from platforms such as Angel.co

Process Of Raising Venture Capital

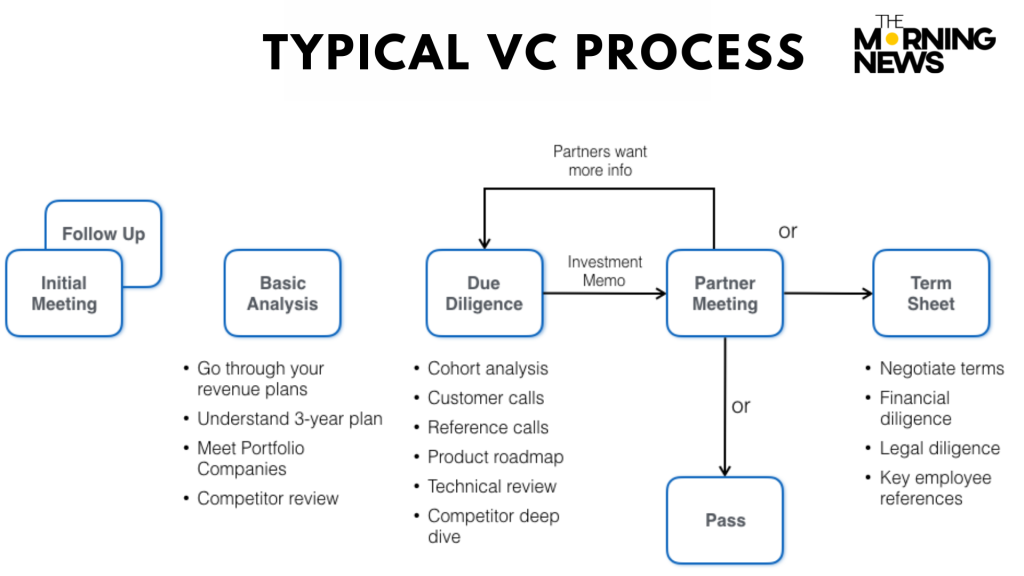

The process of raising a Venture Captial Fund varies in situations but usually, a business that needs funds to expand their company will need a business plan, and sometimes a “pitch deck”, which is usually a few slides of PowerPoint that a potential VC can look over to see if that something they are want to learn more about.

This is followed by the VC doing their due diligence to make sure that everything checks out, such as their claims, revenue, and market valuation. If everything is OK and VC is interested, they will make an offer in exchange for equity in the company. This is offered on something called “Term Sheet”, which is just a fancy name for the document that shows what they are offering and what they get such as equity, voting rights, pro-rata, etc.

Players Of Venture Capital

Most people think that there are only two players in the Venture Captial transaction: VC and the Entrepreneur but in fact, there is also the involvement of lawyers, accountants, banks, and syndicates.

Entrepreneur: This is someone who owns a business or has a plan for a business. Usually, their motive is to gather as much money as they can without giving up too much equity to run and take the company to the next level. Diffrent entrepreneurs have different goals, some want to keep running the company, some want an exit by acquisition and some have dreams of taking their company public.

Venture Capitalist: This is the company/group of people investing money. They have fancy titles such as “General Partners”, meaning they are executives, or sometimes, they will all have the same title which means nothing. The firms usually have a scout, which goes around speaking with entrepreneurs or finding the next company, they earn a commission or small equity if the deal is finalized. You should be careful who you speak with because most of the people on the front end do not have the authority to close the deal but they can help you pitch your company the the “Principal” of the VC firm. Diffrent VC firms have different goals, some are looking to invest in certain kinds of companies, while some want a collection of everything. They understand that startups are the riskiest investment asset, but also the most lucrative. Think about investing $50K in an early company as seed money ( Read, Gamble Money ) and that company collects more money, raising its valuation, and eventually doing an IPO.

Lawyers: The people with fancy suits ( usually not in this industry ), are the people who can either HELP you get the best deal on either side or screw up your relationship with Entrepreneur or Venture Capitalist. Both parties, Entrepreneurs, and VC will have a lawyer who will negotiate the “Term Sheet” to make sure you are getting the best deal. It’s best to let your lawyer know what you want and control them properly.

Accountant: In early stage fund raise, you will usually see accountants who are trying to help Entrepreneurs save money on tax and make sure accounting is done correctly.

Bank: Investment bankers usually charge a substantial fee to help companies raise funding from VC firms. They are hired by entrepreneurs to help them run the show. Normally, VCs and Angel Investors don’t respond well because they could work directly with the entrepreneurs to save both of them money. Investment bankers are usually helpful in late-state financing in certain cases.

Next: How To Prepare For Fundraising